Board Governance in 2026

Redefining board leadership to meet modern challenges

Looking toward 2026, the responsibilities and expectations placed on corporate boards continue to evolve at an accelerating pace. Today’s directors are navigating a business environment shaped by a broader range of risks, fresh opportunities, and new approaches to leadership and oversight. The start of a new year represents an inflection point for board directors to consider how they can respond with informed action to embrace change.

The role of the modern board is expanding. Boards are expected to look beyond compliance and traditional oversight, stepping into roles as strategic oversight leaders and stewards of enduring value. Directors are increasingly pivotal in guiding organizations through uncertainty to help foster growth and resilience amid disruptions such as economic and geopolitical shifts, digital transformation, and regulatory developments. Effective boards are often those that keep pace with these shifts, regularly evaluating not only what they oversee but how they do so.

Governance in 2026 and beyond is likely to be, at its core, about enabling boards to guide their organizations through change with confidence.

By focusing on adaptability, proactive engagement, and continual learning, boards can position themselves as anchors of stability and stewards of innovation and growth in an increasingly dynamic world.

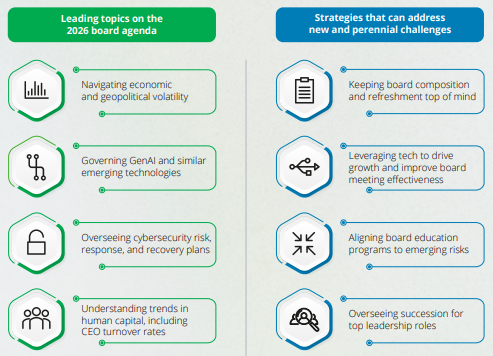

US respondents to a recent Deloitte Global Boardroom Program survey indicated they are increasing their focus on the effects of geopolitical and economic volatility, rapid technology advancements, cybersecurity, changing regulations, and shifts in human capital. The results suggest boards may recognize that traditional approaches could be reimagined to meet the demands of today’s environment.

Topics on the 2026 board agenda

The risk landscape facing boards is both broader and more interwoven into daily operations than ever before. As a result, the following items could make regular appearances atop the board’s agenda throughout the next year:

Economic and geopolitical volatility

Ongoing volatility in trade, economic uncertainty, and regulatory developments can define the environment for both enterprise operations and board discussions. Boards are navigating shifting policy directions and market conditions amid uncertain economic forecasts, persistent inflation, and the impact of geopolitical tensions on supply chains. They are also keeping up with evolving regulations and new compliance mandates.

AI and emerging tech governance

Boards are moving from theoretical discussions to decisive, agile governance of artificial intelligence (AI) and other disruptive technologies, confronting new complexities and responsibilities with practical, forward-looking action. Many organizations now deploy AI and automation tools in business processes, raising board discussions around innovation, ethics, accountability, the workforce, and evolving regulatory expectations. Boards are building the experience to provide meaningful oversight, aligning technology initiatives with organizational values, legal requirements, and stakeholder expectations.

Cybersecurity

As ransomware, data breaches, and technology-infrastructure vulnerabilities grow more sophisticated, directors are expected to understand their tactical and strategic impacts. Effective oversight includes attention to operational resilience, supply chain dependencies, and reputational consequences. Directors— regardless of committee—should consider not only protection against cyberthreats, but also rapid detection of incidents, coordinated response, and timely recovery.

Human capital trends, including CEO turnover

According to the 2025 Spencer Stuart Board Index, CEO turnover at S&P 500 companies rose nearly 30% from 2024, to 61 new appointments in 2025 from 47 the year before.[2] The report indicates many of these appointments involved internal promotions and first-time leaders. It also indicates a slight decrease in average tenure for departing leaders, with approximately one-third serving in their roles for less than five years. A Russell Reynolds report indicates a trend toward elevated levels of CEO turnover and shortening tenures globally as well.[3] Taken together, these data points indicate an increase in CEO turnover that should prompt boards to evaluate their approach to succession planning and consider whether the board is adequately prepared to deftly manage these changes in leadership at the top of the organization.

Audit committee focus for 2026: What’s ahead

As audit committees plan for 2026, their responsibilities will likely be shaped by the dynamic environment, regulatory shifts, evolving technologies, increased stakeholder expectations, and emerging business risks. While many priorities overlap with the board’s agenda, certain topics remain important for audit committee oversight:

Stay tuned for further insights and guidance that may help audit committees navigate 2026’s evolving risk landscape.

Board effectiveness practices worth considering

As governance expectations rise, boards may need to consider and evaluate their own effectiveness through a new lens. To provide the leadership, stewardship, and oversight needed by boards, the approach to governance may need to address today’s challenges.

A central area of focus as boards reassess their effectiveness is succession planning. With CEO turnover rates rising and executive tenures growing shorter, boards might consider treating leadership succession planning as a continual, proactive process rather than an episodic task. This approach calls for clear protocols, proactively developed talent pipelines, and regular scenario planning exercises to yield greater agility.

At the same time, day-to-day board practices are evolving to meet modern demands. Integration of technology—from secure sensing portals for hosting board education and materials to leveraging digital twins for scenario planning—has become an operational necessity. Many boards are reimagining agenda design to foster deeper, more focused discussions, emphasizing time management and issue prioritization. Focused pre-read materials and streamlined communications across stakeholders are often seen as table stakes for enabling informed decision-making and effective oversight.

As the scope of board responsibilities continues to expand, ongoing director education may provide significant value to the organization. Some boards are embracing structured learning portals, targeted external briefings, and opportunities for ongoing training in both technical and leadership domains. Such a commitment can help directors maintain the agility needed to guide their organizations through an ever-shifting landscape.

Other approaches that could help boards navigate new and perennial challenges include:

Governance practices

Adaptability is an increasingly important board discipline, whether to crises or changes in regulation. Scenario planning exercises and crisis playbooks are important to prepare for foreseeable threats and enable swift, coordinated responses when surprises arise. Boards should routinely oversee testing of contingency plans to strengthen agility and maintain stability during periods of uncertainty. Actively monitoring changes, fostering transparency, and expecting careful oversight of suppliers and partners as part of a third-party risk management approach can also be part of this expanded governance toolkit.

Defining risk appetite

Directors can sharpen their focus on risk appetite and alignment with management regarding acceptable risks and organizational boundaries. Establishing guidelines can accelerate effective decision-making and help boards and management teams navigate new challenges and opportunities. To guide and inform oversight, boards are increasingly leveraging real-time analytics and dashboards, making certain that directors have timely access to relevant information. Tracking and aligning risk appetite with company priorities and promoting effective communication between the board and management are central to resilience.

Board composition

Many boards are taking deliberate steps to align their composition and skills with a rapidly evolving risk and opportunity landscape. For some boards, that may mean bringing on directors with experience relevant to the changing landscape for that company and sector. Continual board refreshment, thoughtful discussions about term limits, and a focus on recruiting for required skills and perspectives may help boards keep pace with shifting stakeholder and organizational demands.

Advancing board leadership in a dynamic era

As we look to 2026 and beyond, effective boards are likely to be those that not only adapt to change but actively help shape it. Effective directors will likely be those who approach their evolving responsibilities with open-mindedness, clarity of purpose, and a commitment to continual learning and improvement. By strengthening governance fundamentals while also embracing innovative practices, boards can help position their organizations to thrive amid volatility and complexity as it continues to unfold.

With vigilance, agility, and collaboration, boards have an opportunity to inspire trust, guide organizations through uncertainty, and oversee sustained value creation for stakeholders. In this way, they can become the anchors of stability and engines of growth and innovation that many organizations need to navigate a complex and uncertain landscape.

Conversation starters for board leadership into 2026

These questions can spark board dialogue about how effectively the board is fulfilling its responsibilities and what measures it can take to help drive organizational resilience.

- Are we proactively managing succession planning for both the board and executives?

- Is our risk appetite well-defined, aligned across board and management, and balanced between risks and opportunities?

- How ready are we to respond to emerging risks and disruptions?

- Does our board’s composition meet current and future needs?

- Are our meetings and materials enabling timely, focused decisions on critical issues?

1 In addition to the top priorities shown in the chart, US respondents also cited regulation (36%), new markets (34%), sustainability (18%), stakeholder expectations (16%), and supply chain disruption (13%) as important trends. (go back)

2 Spencer Stuart, U.S. Spencer Stuart Board Index, 2025. (go back)

3 Russell Reynolds, Q3 global CEO Turnover Index, 2025. (go back)

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.